Shanghai Aluminum fell this week and probed the recent lows. The main contract AL0608 closed at 2,1080 yuan/ton this week, down 890 yuan from the previous week, with an amplitude of 1,700 points and 21,000 points showing support. Aluminium closed at 2,645 U.S. dollars per tonne, a drop of 143 yuan from last week. The market continued to decline, and the upward trend in the previous period changed. High inventory pressure made the aluminum futures fall more fierce, and the current shock test support. Aluminium’s position has also been reduced and the fund has taken profits.

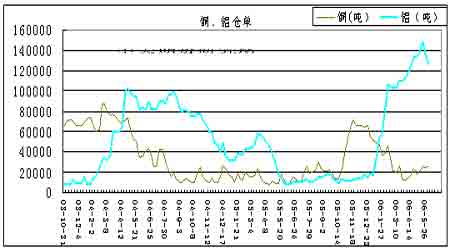

Inventory has dropped significantly for two consecutive weeks, indicating that the pressure on resources has become larger and it has started to ease. Shanghai warehouse receipts dropped sharply this week. Shanghai Aluminum's registered warehouse receipts were 125,734 tons, which was a decrease of 10,974 tons from last week. At the same time, Shanghai Aluminum's resources were also reduced by 8,403 tons. This year's warehouse receipts are in a state that exceeds the high level of last year's warehouse receipts, indicating that the electrolytic aluminum market has sufficient supply and manufacturers have significantly increased their efforts to preserve the futures market. Aluminium aluminum stocks also remained high. Huge amount of warehouse receipts will pose greater pressure on prices. With the deepening of the peak season of consumption, the demand has increased. At the same time, the price difference between aluminum prices at home and abroad is close to the conditions for export. The export of electrolytic aluminum will likely increase, and it will continue to push down the inventory.

Spot prices fell slightly this week. On May 26, the price of spot aluminum ingots in the Yangtze River region of Shanghai closed at RMB 21,720. As the spot price fell, the downstream consumer demand appeared to wait and see attitude, the sellers accelerated sales, and the market transaction volume dropped. Due to the high prices in the southern market, some traders bought goods to arbitrage in the southern market, leading to a reduction in local inventories in Shanghai.

Aluminium prices were under pressure this week, and production capacity increased rapidly and prices were restrained. The price of port alumina and the price difference between domestic alumina and alumina have narrowed to 650 yuan/ton, and China Aluminum Corporation's East China alumina spot price has reached 5,650 yuan/ton. In March, some domestic alumina production capacity will be put into production, which will increase the supply of alumina, thus inhibiting its price increase. At the same time, China's alumina imports have declined. According to customs statistics, alumina imports amounted to 7.02 million tons in 2005, an increase of 19.6% from the previous year; and in April of 2006, imports totaled 2.21 million tons, a year-on-year decrease of -12.3%. Overall, China's electrolytic aluminum industry is still in an expanding trend, and promotes the alumina price to keep rising. Alumina import duties have now been reduced from 8% to 5.5%. Moreover, the decline in alumina prices generally lags behind the decline in aluminum prices. Only when the decline in electrolytic aluminum prices causes aluminum producers to reduce production and thereby reduce alumina demand, it may cause alumina prices to fall.

From a fundamental point of view, in December last year, domestic large-scale electrolytic aluminum producers jointly reduced production by 10%, which was the basic factor that led to the drop in alumina prices and the rise in electrolytic aluminum prices. At the same time, reducing production also supports aluminum prices. However, with Shanghai Aluminum prices rising, the attraction to aluminum resources has increased, leading to a rapid increase in the number of warehouse receipts, the rapid increase in the amount of Shanghai aluminum resources and warehouse receipts, indicating that aluminum production capacity will be restored, alumina demand, aluminum stock supply Abundant, the domestic aluminum plant's efforts to maintain the value increase.

We believe that there is indeed a conflict between demand growth and overcapacity in the domestic electrolytic aluminum industry. The decline will have cost support (alumina price and electricity price increase) and aluminum demand support. Rising will cause the contradiction between demand austerity and excess production capacity, and will inevitably encounter high inventory pressure. The way to break the stalemate lies in the active shrinkage of the aluminum industry. As a result, aluminum prices will rise again; or the macroeconomic slowdown, and the total aluminum demand will decline, the current aluminum trend will reverse. If the two conditions are difficult to see in the short term, the aluminum price will maintain a turbulent process.

In a nutshell, the Dow Jones stock index fell sharply as the US core inflation index exceeded expectations, triggering a large number of futures market funds, such as crude oil and metals, to sell off, thus ending the general rise in industrial product futures. At the same time, the pressure on the high level of inventory has increased, which also forces the aluminum price to decline. However, we must also realize that the panic-related decline caused by the profit-taking of the fund is more of an adjustment nature. The general trend cannot be said to have changed fundamentally, and inventory pressure is also rapidly released. Therefore, after the loosening of the risk of policy regulation, there may be substantial shocks. The current market is running in the process of low support of the oscillating test.

Basics:

Shanghai aluminum warehouse receipts decreased significantly, resource pressure began to reduce

As of June 2, the inventory of aluminum stocks in the previous period was 168,111 tons, which was 8403 tons, and the registered warehouse receipts were 125,734 tons, which was 10,974 tons less than last week (see the following figure). With the Shanghai aluminum price rising, the attraction to aluminum resources has increased, resulting in a rapid increase in the number of warehouse receipts, and has exceeded the high level of last year's warehouse receipts. The amount of aluminum inventory resources and registered warehouse receipts have been significantly reduced for two consecutive weeks, indicating that the pressure on resources has been greater and will be reduced.

May 2006 Major progress of global aluminum market fundamentals, prices and inventory

In early May, aluminum prices hit record highs driven by speculative buying and supply concerns, but some analysts believe that the increase in output may not be conducive to aluminum prices continue to rise.

SGCIB analyst Briggs said: I think the aluminum market can still perform, but time is running out. . . Alumina production capacity will soon increase, and aluminum production will follow. Macmillan, a mining analyst with Bache Financial, said that aluminum stocks have risen and there is almost no supply shortage, especially in China. TRUq Salari, an analyst at CRU International, said that the market has technical corrections, but the long-term outlook is still promising. If the fund decides to withdraw quickly from the copper market, it is even better, he said that the high energy prices have created a bottleneck for the metal smelting industry.

The following are details of the recent major changes that may affect the aluminum industry's production, inventory, and prices in 2006:

produce

May 31 - Alcoa reached a temporary four-year labor agreement with 9,000 workers at 15 factories. Workers previously affiliated with the North American Iron and Steel Workers Union (USWA) authorized a strike in the event of a failed negotiation.

May 22 - Preliminary data from the International Aluminum Association (IAI) show that the average daily output of primary aluminum in April was flat at 65,300 tons in March, compared with 63,800 tons in April 2005.

May 12--Prime Tass news agency reported that Russia's primary aluminum production in January-April this year was 1.22 million tons, an increase of 2.2% over the same period of last year.

May 11--The Aluminum Association of America announced that production of primary aluminum in the United States in April was 2,309,963 tons, a 9.9% decrease from the same period of last year. The total output so far this year is 2,319,894 tons, a year-on-year decrease of 7.5%.

price

Promoted by speculative buying, aluminum prices rose by nearly 20% or 540 US dollars from May to May 11, to a record high of 3,310 US dollars. However, the market followed cautiously, and aluminum prices fell after May 11 and fell below the beginning of the month at the end of the month.

January Reuters survey of 29 analysts' semi-annual base metals showed that the spot aluminum price in 2006 is expected to be 94.8 cents per pound (approximately $2,090 per ton). However, April Reuters survey of 13 analysts revised this estimate to 104.3 cents (about 2,299 US dollars per ton).

in stock

At the end of May, the aluminum stocks of the Exchange totaled 985,603 tons, which was higher than the 959,679 tons one month ago. The LME stock was 771,425 tons. The total inventory, including the unprocessed stocks of the International Aluminum Association (IAI), was 2.655 million tons, equivalent to 29 days of consumption.