According to the data released by the OECD, the total gross domestic product (GDP) of the 30 members of the organization increased by 0.9% from the previous quarter and 3.1% from the same period of last year.

US consumer confidence index fell to 103.2 in May

The U.S. news that the talks on the Iran issue will be cracked against the price of crude oil, but it will pick up.

According to data released by the American Institute for Supply Management (ISM), the manufacturing index fell to 54.4 in May from 57.3 in April, the lowest level since August 2005

New York Commodity Exchange (COMEX) will abolish the price fluctuations of all futures contracts

Cananea copper miners belonging to Grupo Mexico started a four-day strike on the 1st

Copper concentrate processing fees (TC/RC) continue to drop sharply, and smelting companies are hard to continue

First, the market review

This week, the international copper and aluminum market continues to fluctuate, and the market continues to recover the sharp rise in copper prices in the previous period. Among them, copper prices continue to fluctuate at a high level, and aluminum prices hit a new low since the adjustment, showing that they are in the same edition. The rhythm of different breeds is different. However, the market's overall operating trend will not be too different. The structure of the adjustment and restoration still shows the demand for a stronger market. The pace is bright and the market progresses smoothly. On Monday, due to Memorial Day in the United States. As well as the Bank of England holiday, the international market closed. After the deal resumed on Tuesday, the fund closed lower again under the blow of another liquidation. The news that workers of the Canadian nickel company, lnco ltd, changed the strike plan lowered the price of nickel and also affected the copper market. The data released on the day did not boost prices. According to the data released by the Organisation for Economic Cooperation and Development (OECD) on the 30th, the total GDP of the 30 members of the organization in the previous quarter has increased by 0.9% from the previous quarter. Year-on-year growth of 3.1%. The increase in this quarter was higher than the quarterly increase of 0.6% in the fourth quarter of last year. It shows that the global mainstream economic development is still very healthy, and the market's operating environment is still good. The US consumer confidence index fell to 103.2 in May, which is also higher than the 102 forecast. But the market is obviously unmoved and falls back under the influence of fund settlement. On Wednesday, after completing the technical rebound, it tested again within the range. The lower-than-expected chain retail sales announced that night also hit the market. The U.S. news that Iran will launch negotiations on Iran will hit crude oil prices. Affected. Redbook Research's newer nationwide retail index released on the 31st showed that retail sales of US-wide chain stores fell 3.0% in the first four months of May from the same period of last month. The report said that the decline of the index was higher than the expected decline of 2.6%. After adjusting for seasonal factors, sales for the four weeks before May increased by 3.1% from the same period of last year, which was lower than the expected increase of 3.5%. Redbook said that retail sales increased by 2.5% in the week ending May 27 compared to the same period last year, without seasonal adjustments. Continued its downward trend on Thursday, affected by the relatively new manufacturing index, COMEX has a daily limit in the session trading. The LME market also dropped to a low of 7,300 US dollars. The US Institute of Supply Management (ISM) released data on the 1st. The U.S. manufacturing index fell to 54.4 in May from 57.3 in April, the lowest level since August 2005. A reading above 50 means manufacturing expansion, which has been above 50 for three consecutive years. The US ISM manufacturing index in May was below analysts’ median forecast of 55.6. The data also showed that the US ISM employment sub-index fell to 52.9 in May from 55.8 in April, but the price payment sub-index rose from 71.5 in April to 77.0, which is the highest level since October 2005. Inflationary pressures rise. At the same time, as interest rates continue to rise, the market believes that the US economy may slow down and commodities are generally suppressed. Copper prices are close to the previous adjustment lows, while aluminum prices hit a new low since the adjustment. On the Mexican group strikes on Friday Under the influence of the weak US dollar, the copper and aluminum market experienced a bargain-hunting intervention. Copper prices triggered short stop-loss on the upside, copper prices closed higher, and aluminum prices also showed signs of recovery. Copper week K line is the upper shadow line 130 Point, the lower shadow line 515 points, the entity is 485 points of the big Yin line. The aluminum circumference K line is the upper shadow line 58 points, the lower shadow line 110 points, the entity is 143 points in the Yin line. Still adjust the line structure for the shock.

Second, the review and assessment of the previous week's views

In the report of last week, the author remarked: “The international copper and aluminum market has not changed its overall bull market operation pattern in the healthy market environment of Zhoubian. At the same time, the short-term shock adjustment market is still in operation. This week’s rise cannot be positioned as an adjustment. At the end, the market may still be rebounding among the B waves, of which the aluminum price will test the resistance at the top of 2910 dollars, and the copper price will be under pressure in the first line of 8510. The new operating space of the market is currently not open, and the shock adjustment is still the tone of operation. "The viewpoint is basically consistent with the market. Copper prices rebounded short-term after reaching the upper resistance level in the B-wave rally. In the subsequent fall, the market continued to run in a range-bound rhythm. Copper prices fell in the convergence-shaped C wave. Did not touch the low point of the previous adjustment, while the aluminum price of the zigzag C wave hit a new low since the adjustment. The initial recovery of the weekend determined that the C-wave has already ended and the market may have been operating in the rebound of the D-wave. Aluminum prices do not show this characteristic.

Third, the market structure

The slow declining trend of stocks is still continuing. As of now, the copper stocks in the LME market have fallen to 109,800 tons, and the number of canceled warehouse receipts is still increasing, which is currently 21,100 tons. Aluminum inventory was 769,400 tons, and cancellation of warehouse receipts was 55,900 tons. The decline in the displayed inventory will continue. At the same time, the market's positions are still hovering at a high level. The total number of copper positions is 246,626, and the spot month is 31,770 lots, which are 56 times and 7 times of inventory, respectively. Obviously, under such a ratio, the delivery pressure facing the bears is still not small. In contrast, aluminum market holdings are relatively modest. As for the large positions, the short positions in a large 5-10% position in the June position are obviously concentrated, and there are 5 positions with 5~10% positions, apparently under this position structure. Once again, the bears face the plight of delivery. Copper prices will be unavoidably supported. The aluminum market is difficult to cause large fluctuations due to the more balanced positions in the spot month. From the options point of view, this cycle of rights contracts has been lightly traded and positions have not changed. The previous option analysis has not changed. Due to the rapid increase in the price of copper, the trading space of options has not kept pace, among which the call option has no position above 5600 US dollars, while the put option basically remains below 5700 US dollars. Therefore, the price of copper in June is as long as the previous Wednesday. Maintaining above 5700 USD, the put option buyer will experience a full retreat and the seller will be able to hold the premium without having to pay for it. The seller of the call option will be under $5,200 to $5,600. The positions will be forced to buy futures contracts due to announcements. In other words, as long as the copper price stays above 5600 US dollars before the arrival of the previous Wednesday in June, the market will be supported. On the aluminum options position, we see the put options. There are few positions in the middle of 2,600 dollars, while call options have accumulated large positions in 2,400 dollars, 2,600 dollars, and 2,700 dollars. Therefore, call options are as long as the option announcement is maintained above 2600 dollars. The buy will have the opportunity to be executed, the seller must buy the futures contract, the put buyer is forced to give up, the seller will take all the premiums and the market will also be affected. To support.

Fourth, this week's market focus

As the price of copper fluctuates at high levels for a long time, the traditional rules are faced with many challenges. It is obviously difficult to set the margin to control the risks within the range of copper prices in front of them. The mere way to increase the margin does not seem to be reasonable. After all, it is the guarantee of futures contracts. It is impossible to use a large amount of funds for protection, so the market has already faced the problem of re-establishment of contracts. Otherwise, the liquidity of the market will be seriously hurt. At the same time, due to the restrictions of price hikes and suspensions, there are often suspensions in the current hungry trading, which also affects normal trading. The New York Mercantile Exchange I (NYMEX) has taken the lead in changing this unreasonable situation. This week it announced that its New York Mercantile Exchange (COMEX) will cancel the restrictions on price fluctuations of all futures contracts. This change will take place in June. On the 4th (Sunday) day in NYMEX's ACCESS Electronic Trading System, NYMEX stated that "the purpose of this change is to better realize the core functions of price discovery and hedging in the COMEX market futures contracts." COMEX market Futures are gold, silver, copper and aluminum. The author believes that this type of continuous and targeted solution to the problems faced by the market is positive. In the new historical period, the new changes in the market require managers to provide targeted solutions. The measures, instead of allowing them to develop, hope to see more reforms that will enable the market to continue healthy development and create a favorable investment environment for investors.

The issue concerning copper concentrates has aroused serious concern from investors. With the strong growth in consumption, the diameter of copper concentrates has become increasingly apparent, and the global supply of copper concentrate has become more intense. Following the decline of the global benchmark TC/RC from 170/17 at the beginning of the year to 70/7 at the end of April, a lower smelting fee was reached between some copper mine suppliers and smelters in May. In late May, the US GERALD METALS INC and Chile MINERA ESCONDIDA LTDA reached a processing fee of US$30 and 3 cents/lb, compared with US$40 and US$4 processing fees for the GOLDEN GROVE copper mine transaction of the NORMANDY Mining Company in Australia. Points/lbs. In this way, for countries that lack resources to blindly develop the smelting industry, such phenomena will lead to serious supply shortages. Very low processing fees will make it difficult for some enterprises to survive and production will be greatly affected. Another problem is that the tension in copper concentrates will also encourage more strikes. Some labor and capital in some countries will once again have disputes due to the problems of corporate income and labor treatment, resulting in more strikes. This is particularly worrying to insiders. Since then, copper prices will continue to be stimulated by events.

More worrying is the supply problem of China, a large consumer of copper. Due to the problem of spread structure, logistics has been significantly reduced. Data released by the General Administration of Customs on Monday showed that most of China’s metal imports and exports were slowed down in April. Refined copper imports decreased by 33.2% year-on-year to 71,106 tons, and total refined copper imports fell by 36.3% year-on-year to 276,944 tons in January-April due to high international prices and domestic smelter capacity expansion to cut imports. In April, China’s primary aluminum export volume decreased by 23.3% year-on-year to 82,785 tons, and total primary aluminum exports in January-April also decreased by 27% year-on-year to 280,634 tons. In April, alumina imports decreased by 34.2% year-on-year to 511,316 tons, and the total volume of alumina imports in January-April fell 11.8% year-on-year to 2.214 million tons. The reduction in exports of primary aluminum led to ample supply of aluminum in China, and the reduction in imports of refined copper will make supply tight, and the continuous decline in copper processing fees has made it difficult for Chinese smelters to sustain their consumption. Of the 3.9 million tons of consumption this year, Domestic copper concentrates can only solve 650,000 tons, and nearly 2.6 million tons of 2.6 million tons of production are dependent on imports. Once the bottle diameter of copper concentrates is introduced and imports of refined copper are blocked, serious supply and demand conflicts will be resolved. The price of copper has been pushed to the extreme and investors are extremely concerned about this.

In order to alleviate these problems and prevent the shortage of resources from flowing backwards, the Chinese government will cut the export tax rebate rate for metal products from July 1 this year, and the export tax rebate rate for some metal products will be reduced from the current 13% to 5%. It is said that this adjustment will involve metal products made of copper, aluminum, lead, zinc, tin and nickel. An official of the State Administration of Taxation said that various departments are currently studying the matter. Obviously, these measures are intended to protect resources that are already in short supply, to avoid the unfortunate incident of the State Reserve's throwing copper, and to prevent the blind development of the high energy consumption processing industry from causing losses to the country. The author appreciates this pragmatic attitude of the government and measures to solve the problem.

The ongoing strikes continued to affect the nerves of the market. As the price of copper continued to rise, there was no sign of a reduction in such incidents. This week, the Cananea copper miners under the Grupo Mexico Group started on the 1st for a period of four days. The strike continued as the company insisted on letting them work for the 100th anniversary of the first mining strike in Mexico. Francisco Hernandez, leader of the Cananea Mining Union, said that 1,500 workers wanted to participate in the first mining strike in Mexico. The strike occurred in 1906 in a mining town near the US border. The workers currently join the ranks of other miners who have been on strike for more than two months at the La Caridad copper mine of the Mexican group. The Cananea Copper Mine produced 118,741 tonnes of copper concentrate in 2005 and La Caridad Copper Mine produced 122,317 tonnes. Whether the strike will evolve demonstrations of growing time, market participants are more concerned, and copper prices are again supported by this.

V. Institutional perspectives

Man Financial: Copper Support: 7600 Resistance: 8250 We believe support is at $7,600 and the next support is at $7,250/t and $7,000/t. Concerns about the Far East's inventory and SRB's measures have affected the market. Aluminium support: 2450 Resistance: 2700, the termination of the strike that Aluminium may have broke out in the market.

Marex: The long-term upward trend of copper remains intact, and the short- and medium-term technical pattern continues to deteriorate. The current market is fluctuating back and forth. However, unless it breaks the $7250 mark, the market will oscillate further and it is expected to test the recent resistance at 7940/60 USD. Breaking this position will ease the current downward pressure and continue to rise. A close below $7,250 shows that the top formed and will trigger further declines to the $6,970 or even $6,180 area.

The Standard Bank Steel Workers Union reached a new four-year labor contract with Alcoa, involving about 9,000 workers in 15 factories. Negotiations between the two sides began on May 18, when the market was supported due to unknown results. However, after the announcement of the agreement, the market's support factor disappeared, aluminum prices weakened, and the fundamentals remained weak. In addition, Century Aluminum announced that it had reached an agreement with the Steel Workers' Association to postpone the current labor contract until June 14 in order to gain more time, which also increased downward pressure on the market. We expect copper prices to remain broadly volatile and further decline, but this is not the end of the upward trend.

Sempra Metals Co., Ltd. economist John Kemp said at the 3rd Financial Derivatives Forum held on May 27th that copper walking is a result of fundamental and speculative factors. Although the bull market is currently in the mid to late stage, But there are still no signs of ending in the short term.

Societe Generale said on Tuesday that the current fiery base metal market is comparable to the 2000 Internet stock bubble in many respects, but it is difficult to say when the bubble may burst. SGX is a dealer of the London Metal Exchange (LME) and an important participant in the commodity market. According to the French Industrial Bank, many features of the sharp rise in the prices of industrial metals such as copper and zinc are similar to those before the collapse of technology stocks. In both cases, those traditionally trusted asset valuation methods have been abandoned, and argument arguments that may favor certain assets have been applied to another asset without thinking.

A report released by Macquarie Research on Monday showed that aluminum is still expected to be a poor performer of base metals this year. The data released by the International Aluminum Association (IAI) last Friday showed that Western aluminum production in April The total amount of various types of aluminum inventories held by businesses increased by 79,000 tons to approximately 1.67 million tons, although seasonal demand was strong. Analysts at Macquarie Bank stated that while IAI's data may partially reflect the unusually large reduction in aluminum stocks in March, the data is still disappointing and shows that the aluminum market is not as tight as other base metals. They said: “With the rapid growth of alumina production in China, the alumina market has begun to show signs of slowing down, and the end of the tight supply situation in the aluminum raw material market is not conducive to the aluminum bull market. This requires supply issues or strong demand to promote The price has risen from the current level."

UBS said in a report that although China’s production has increased, the global alumina market may remain strong as smelters rebuild their inventories. UBS Basic Metals analyst Robin Bhar said spot alumina prices have reached a high of more than US$600/tonne, and the current transaction price is about US$570 to US$580/ton, as Chinese imports are being replaced by China’s domestic output growth. .

List of charts

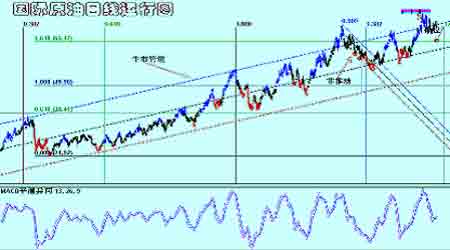

Chart 1

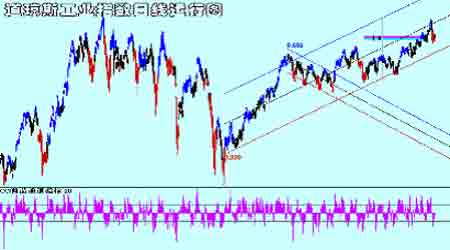

Chart 2

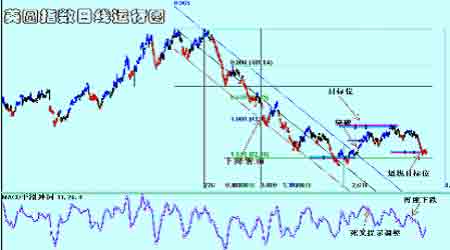

Chart 3

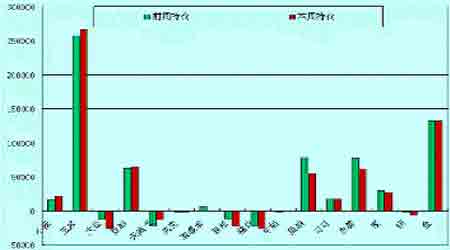

Chart 4